Navigating the complexities of employment and taxes can be a daunting task. This comprehensive guide to employment and taxes Everfi answers provides a clear and concise understanding of the subject matter, empowering individuals with the knowledge they need to fulfill their tax obligations and make informed financial decisions.

Within this guide, we will delve into the various types of employment taxes, employer and employee responsibilities, tax exemptions and deductions, and the consequences of tax penalties and interest. By equipping readers with a thorough understanding of these concepts, this guide aims to simplify the often-complex world of employment and taxes.

Employment Tax Overview: Employment And Taxes Everfi Answers

Employment taxes are a crucial component of the tax system, ensuring that individuals contribute their fair share to fund government programs and services.

These taxes are levied on both employers and employees, with each party responsible for withholding and paying specific portions.

Employment taxes serve the essential purpose of generating revenue for government operations, supporting programs such as Social Security, Medicare, and unemployment insurance.

Types of Employment Taxes

The primary types of employment taxes include:

- Federal Income Tax:Levied on employees’ wages, this tax funds the general operations of the federal government.

- Social Security Tax:Divided into two parts (Old-Age, Survivors, and Disability Insurance (OASDI) and Medicare), this tax supports retirement, survivor, and disability benefits.

- Medicare Tax:Funds the Medicare program, providing health insurance coverage for seniors and individuals with disabilities.

- Federal Unemployment Tax Act (FUTA):Paid by employers, this tax finances unemployment benefits for eligible workers.

- State and Local Income Taxes:Varying by jurisdiction, these taxes are levied on employees’ wages and support state and local government operations.

| Tax Type | Tax Rate | Withholding Method |

|---|---|---|

| Federal Income Tax | Progressive rates based on taxable income | Withheld from employee paychecks |

| Social Security Tax (OASDI) | 6.2% | Split evenly between employer and employee |

| Social Security Tax (Medicare) | 1.45% | Split evenly between employer and employee |

| Medicare Tax | 2.9% | Paid solely by employee |

| FUTA | 6.0% | Paid solely by employer |

Employer Responsibilities, Employment and taxes everfi answers

Employers play a vital role in the employment tax system, with the following responsibilities:

- Withholding Taxes:Employers are required to withhold employment taxes from employee paychecks based on withholding allowances claimed.

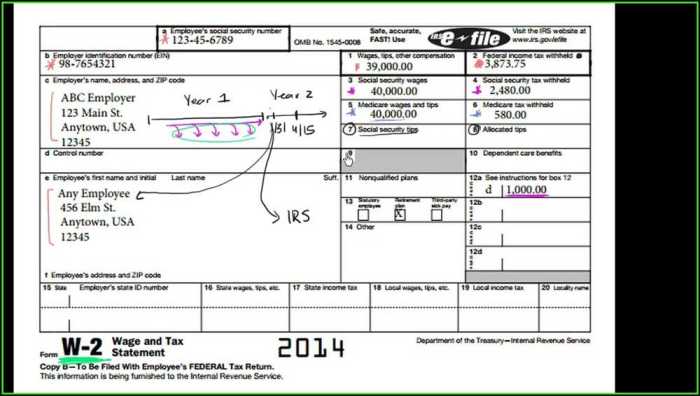

- Filing Tax Returns:Employers must file various tax returns, including Form 941 (Quarterly Federal Tax Return) and Form W-2 (Wage and Tax Statement).

- Making Tax Deposits:Employers are obligated to make timely deposits of withheld taxes to the Internal Revenue Service (IRS) using the Electronic Federal Tax Payment System (EFTPS).

Failure to comply with these responsibilities can result in penalties and interest charges.

Employee Responsibilities

Employees are also responsible for fulfilling their employment tax obligations:

- Paying Taxes:Employees are ultimately responsible for paying their share of employment taxes, which are withheld from their paychecks.

- Completing Form W-4:Employees must complete Form W-4 (Employee’s Withholding Allowance Certificate) to indicate their withholding allowances, which determines the amount of taxes withheld from their pay.

- Filing Tax Returns:Employees must file annual tax returns (Form 1040) to report their income and any taxes owed.

Underpaying or overpaying employment taxes can lead to penalties or refunds, respectively.

Tax Exemptions and Deductions

Certain exemptions and deductions can reduce the amount of employment taxes owed:

- Exemptions:Personal and dependency exemptions reduce taxable income, resulting in lower tax liability.

- Deductions:Expenses such as retirement contributions, health insurance premiums, and student loan interest can be deducted from taxable income, further reducing tax liability.

| Exemption/Deduction Type | Eligibility Criteria | Application Process |

|---|---|---|

| Personal Exemption | Individuals and dependents | Claimed on Form W-4 |

| Dependency Exemption | Qualifying dependents | Claimed on Form W-4 |

| 401(k) Contributions | Participation in employer-sponsored retirement plan | Deducted from paycheck |

| Health Insurance Premiums | Coverage under employer-sponsored health plan | Deducted from paycheck |

| Student Loan Interest | Outstanding student loans | Claimed on Form 1040 |

Tax Penalties and Interest

Failure to comply with employment tax obligations can result in penalties and interest charges:

- Late Filing Penalties:Penalties for late filing of tax returns or making tax deposits.

- Late Payment Penalties:Penalties for late payment of taxes owed.

- Interest Charges:Interest accrues on unpaid taxes from the due date until the balance is paid.

Taxpayers can resolve tax disputes and appeals through the IRS appeals process, which involves filing a formal protest and presenting evidence to support their claim.

| Tax Penalty/Interest | Consequences |

|---|---|

| Late Filing Penalty | 5% of unpaid tax per month (up to 25%) |

| Late Payment Penalty | 0.5% of unpaid tax per month (up to 25%) |

| Interest Charges | Applicable federal short-term rate plus 3% |

Query Resolution

What are the different types of employment taxes?

The main types of employment taxes include federal income tax, Social Security tax, Medicare tax, and unemployment insurance tax.

What is the employer’s responsibility in withholding and paying employment taxes?

Employers are responsible for withholding employment taxes from employees’ paychecks and submitting those taxes to the government. They must also file tax returns and make deposits on a regular basis.

What are the consequences of underpaying or overpaying employment taxes?

Underpaying employment taxes can result in penalties and interest charges. Overpaying taxes may lead to a refund, but it can also delay the availability of funds for other purposes.