Calculate the allowance for uncollectible accounts for south korea – Understanding the calculation of allowance for uncollectible accounts in South Korea is crucial for businesses operating in the region. This guide delves into the formula, methods, and factors influencing uncollectible accounts, providing valuable insights for accurate financial reporting and risk management.

The concept of an allowance for uncollectible accounts is essential in financial reporting, as it estimates the potential losses from customers who fail to pay their debts. In South Korea, specific considerations and regulations impact the calculation of this allowance, which this guide will explore in detail.

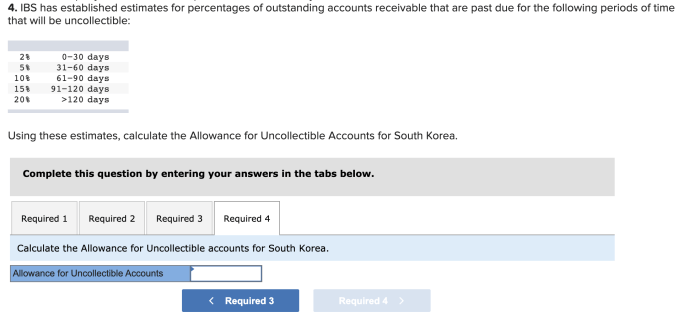

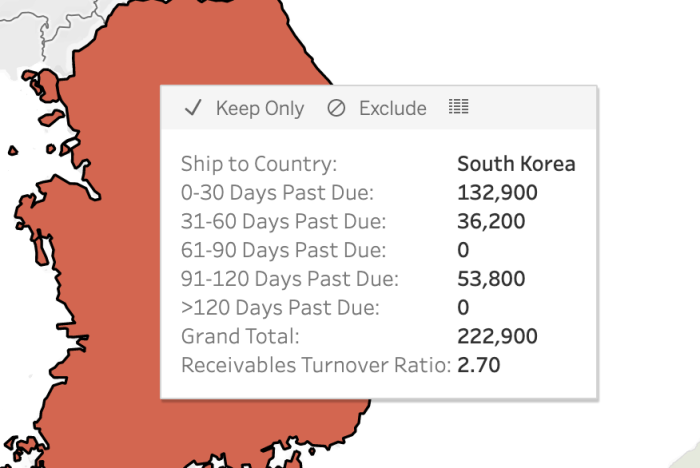

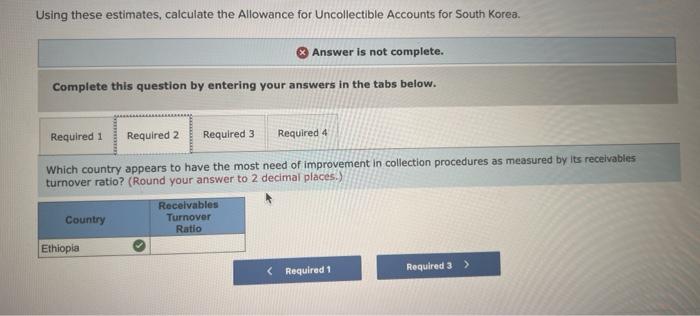

Calculate Allowance for Uncollectible Accounts (South Korea)

The allowance for uncollectible accounts is an estimate of the amount of accounts receivable that a company expects to be unable to collect. It is a contra-asset account that is reported on the balance sheet. The allowance for uncollectible accounts is important because it allows companies to match their revenue with their expenses.

Without an allowance for uncollectible accounts, companies would overstate their revenue and their net income.

Formula for Calculating the Allowance for Uncollectible Accounts in South Korea, Calculate the allowance for uncollectible accounts for south korea

The formula for calculating the allowance for uncollectible accounts in South Korea is as follows:

Allowance for Uncollectible Accounts = Percentage of Sales Method x Net Credit Sales

Where:

- Percentage of Sales Method is a percentage of net credit sales that is estimated to be uncollectible.

- Net Credit Sales is the total amount of sales that were made on credit during the period.

Q&A: Calculate The Allowance For Uncollectible Accounts For South Korea

What is the formula for calculating the allowance for uncollectible accounts in South Korea?

The formula is: Allowance = Estimated Uncollectible Accounts / Total Accounts Receivable

What are the common methods for estimating uncollectible accounts?

Aging of accounts receivable, percentage of sales, and historical loss rate methods are commonly used.

What factors specifically affect uncollectible accounts in South Korea?

Economic conditions, industry trends, cultural factors, and specific laws and regulations can influence uncollectible accounts in South Korea.