In the realm of personal finance, choosing the right savings account is paramount. With compare types of savings accounts ngpf, you embark on a journey to decipher the intricacies of various account types, empowering you to make informed decisions and secure your financial future.

Delve into a comprehensive analysis of interest rates, fees, minimum balances, advantages, and disadvantages, equipping you with the knowledge to navigate the savings landscape with confidence.

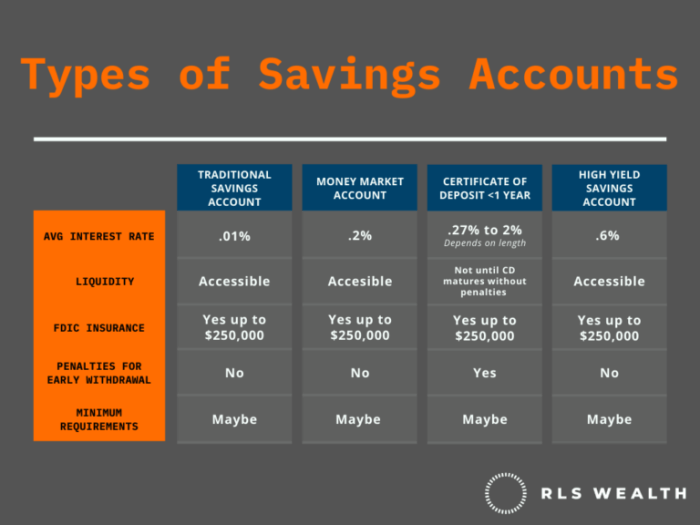

Types of Savings Accounts

![]()

Savings accounts are a great way to save money for future goals. There are many different types of savings accounts available, each with its own unique features and benefits. It is important to compare different savings accounts before opening one to make sure you choose the one that is right for you.

Key Factors to Consider

When comparing savings accounts, there are several key factors to consider:

- Interest rate: The interest rate is the amount of money you will earn on your savings over time. Higher interest rates mean you will earn more money on your savings.

- Fees: Some savings accounts charge fees for certain transactions, such as withdrawals or transfers. It is important to compare the fees of different accounts before opening one to make sure you are not paying too much in fees.

- Minimum balance: Some savings accounts require you to maintain a minimum balance in order to earn interest. If you do not maintain the minimum balance, you may not earn any interest on your savings.

- Accessibility: Some savings accounts are more accessible than others. For example, some savings accounts allow you to make withdrawals or transfers online or at an ATM, while others only allow you to make withdrawals or transfers in person at a bank branch.

Different Types of Savings Accounts

There are many different types of savings accounts available, including:

- Traditional savings accounts: Traditional savings accounts are the most common type of savings account. They offer a low interest rate, but they are also very safe.

- High-yield savings accounts: High-yield savings accounts offer a higher interest rate than traditional savings accounts. However, they may also have higher fees or require you to maintain a higher minimum balance.

- Money market accounts: Money market accounts offer a higher interest rate than savings accounts, but they also have higher fees and require you to maintain a higher minimum balance.

- Certificates of deposit (CDs): CDs are a type of savings account that offers a fixed interest rate for a set period of time. You cannot withdraw your money from a CD before the maturity date without paying a penalty.

Choosing the Right Savings Account, Compare types of savings accounts ngpf

The best savings account for you will depend on your individual needs and circumstances. If you are looking for a safe place to save money, a traditional savings account may be a good option. If you are looking for a higher interest rate, a high-yield savings account or money market account may be a better option.

If you need to access your money quickly, a savings account with an ATM or online access may be a good option. It is important to compare different savings accounts before opening one to make sure you choose the one that is right for you.

FAQ Overview: Compare Types Of Savings Accounts Ngpf

What is the difference between a savings account and a checking account?

Savings accounts are designed for long-term savings and typically offer higher interest rates than checking accounts. Checking accounts are intended for everyday transactions and may have lower interest rates or no interest at all.

How do I choose the right savings account?

Consider factors such as interest rate, fees, minimum balance, and features that align with your savings goals.

What are the benefits of having a savings account?

Savings accounts provide a safe and convenient way to grow your money over time, earn interest, and achieve your financial objectives.